To keep up with the latest updates and news, this guide will be frequently updated accordingly. As such, you may trust that the content written here is recent and relevant.

When incorporating a new Singapore company, aside from determining your Directors, Shareholders, Share Capital and Business Activities amongst others, you would have to also determine your Financial Year End (FYE).

Why does your Financial Year End matter?

Your Singapore company’s financial year end will be the basis by which your Estimated Chargeable-Income (ECI), Annual General Meeting (AGM), and Annual Returns Filing will be due.

In addition, your company’s Year of Assessment (YA) for tax would also be based on the FYE. You want to be able to maximize your tax savings by selecting the appropriate FYE.

Determining your Financial Year End

ACRA allows newly incorporated companies to state its first financial year end within 18 months from the incorporation date.

As such, it is not uncommon for new business owners, or entrepreneurs to set their FYE at 31st December. After all, it is the classic text-book example given and most read about.

This guide is written explicitly to tell you NOT to set your FYE at 31st December, unless with specific intentions. The main reason to not simply set your first FYE at 31st December is simply because you want to maximize the tax exemptions of your newly incorporated company

Do NOT set your FYE at 31st December without reasons. If uncertain, please follow the general rule below.

The general rule is to set your Singapore company’s first Financial Year End according to this formulae:

- Add 1 year to your incorporation date

- Minus 1 month

- Select the last day of that month

As an example, Company X is incorporated on 20th October 2020.

- Adding 1 year – would be 19th / 20th October 2021

- Minus 1 month – would be 19th / 20th September 2021

- Selecting the last day of that month – would be 30th September 2021.

As such, Company X’s first financial year would be 20th October 2020 to 30th September 2021. Thereafter, the subsequent financial year end would be on 30th September each year – 30th September in 2022, 2023, and so on (unless explicitly changed).

Do you know – Leftright Corporate's own FYE is 30th September of every year.

Maximize Your Company's Tax Savings

For a new company to maximize its tax exemptions, the general rule is to try to ensure that the basis period for its first Year of Assessment (YA) is stretched as much as possible within the limit of 12 months.

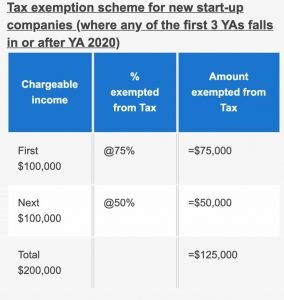

By applying the formulae above in determining your company’s financial year end, you can be assured that you have also maximized the available tax exemptions and savings for your company. As of this writing, the tax exemption for new companies with their first 3 YAs from YA2020 according to IRAS is as follows:

| Chargeable Income | % Exemption | Maximum Amount Exempted |

|---|---|---|

| First $100,000 ($0 - $100,000) | 75% | $75,000 |

| Next $100,000 ($100,001 - $200,000) | 50% | $50,000 |

| Total Amount ($0 - $200,000) | $125,000 |

As mentioned earlier, your tax period a.k.a Year of Assessment (YA) is based on your Financial Year End, and can not be for a period longer than 12 months. Tax is computed according to YAs, and must be filed by 30th November or 15th December if e-filing each YA.

If you were to simply enter your company’s FYE on 31st December, regardless of your incorporation date, you would be wasting your company’s tax exemption.

For example:

Company Y – if first FYE is set as 31st December 2020

Company Y’s incorporation date is 15th July 2020, and has entered its first financial year end as 31st December 2020. This means Company’s Y first financial year end would be 15th July 2020 – 31st December 2020, a duration of around 6 months.

Company Y’s Year of Assessment (YA) would then be YA2021, based only on a period of 6 months from 15th July 2020 – 31st December 2020. In this case, Company Y’s first YA tax exemption of 75% is only applied to this 6 months.

Company Y – if first FYE is set as 31st December 2021

If the first FYE is set as 31st December 2021, then the first FYE period would be 15th July 2020 – 31st December 2021 (still within ACRA’s stipulated 18 months restriction).

Since the basis period for a YA can not be longer than 12 months, the first YA’s basis period will still be from 15th July 2020 to 31st December 2020, and the second YA from 1st January 2020 to 31st December 2020.

As such, your first YA tax exemption of 75% will only be applied for a period of ~6 months (from 15th July 2020 to 31st December 2020), as compared to a period of ~12 months (from 15th July 2020 to 30th June 2021) if the general rule is followed.

Company X

Make in comparison to the earlier Company X, whose first financial year end period is 20th October 2020 to 30th September 2021, a duration close to 12 months.

Company X’s Year of Assessment (YA) would then be YA2022, based only on a period of almost 12 months from 20th October 2020 – 30th September 2021. In this case, Company X’s first YA tax exemption of 75% is only applied to a period of almost 12 months.

Therefore, Company X would have maximized its available tax exemption.

Summary

In other words, to maximize your new company’s tax exemption amount, you should set your first financial year end to be as long as possible to a period of 12 months, and you can do so by applying the formulae mentioned above.